KEY POINTS:

- EUR/USD Eyeing a Potential Break of the 1.05 Key Level.

- Dollar Index and US Data to Remain Pivotal to the Pairs Next Move.

- China’s Growing Covid Numbers Could see Dollar Haven Demand Return.

EUR/USD FUNDAMENTAL BACKDROP

The Euro has enjoyed a positive start to the London session rallying 100-odd pips against the greenback from Asian session lows around 1.0340. The pair closed last week above the resistance area around 1.0350 which was its highest close since June 2022. The move seems to be largely dollar driven at this stage however we have had a batch of surprising data releases from the Eurozone coupled with a hawkish rhetoric from ECB policymakers which could be seen as partly responsible for the buoyant mood around the Euro of late.

The pair faced downside pressure in the Asian session as growing Covid protests in China weighed on sentiment. Protests erupted in Shanghai over the weekend as frustration continues to grow over the ‘Covid-Zero’ strategy. Chinese officials have doubled down this morning vowing to curb the rapid growth in case numbers while confirming their intentions to keep the effects on the economy to a minimum. The Chinese government reported record Covid numbers for a fifth day in succession.

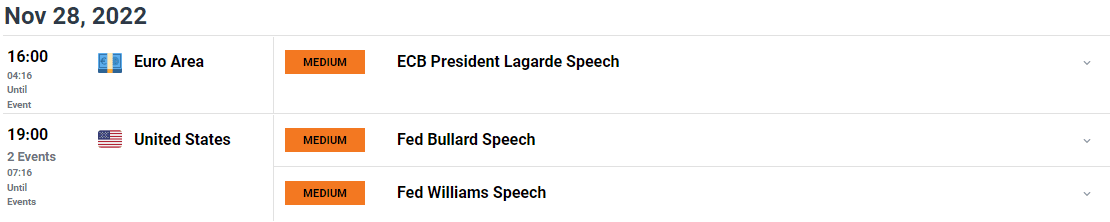

US markets return to normal today following last week’s Thanksgiving break. The dollar index enjoyed a bullish Asian session as haven demand returned. The index has however failed to sustain those gains as European trade began retreating toward November lows around the 105.30 area. There is a real possibility that EUR/USD makes a run for the 1.0500 key level and above in the early part of the week before Eurozone and US data releases potentially halt the rally. The day ahead is relatively light on the calendar front with the main events being speeches from Federal Reserve policymakers John Williams and James Bullard (both hawks) which could help arrest the dollar’s slide. European Central Bank President Christine Lagarde is also scheduled to address the European Parliament in Brussels later today.

From a technical perspective, EUR/USD finished last week with a candle close above a key resistance area around 1.0350. The pair had seen two failed attempts to close above this level in recent weeks before closing above for the first time since June 2022.

The pair now trades above the 200-day MA for the first time since June 2021 which could add further encouragement for Euro bulls. The 1.05 level remains key to any further upside with the pair set to remain at risk of retreat should it fail to record a daily candle close above.

EURUSD Daily Chart – November 28, 2022

No comments:

Post a Comment