- WTI holds lower ground nearly the yearly bottom, sidelined of late.

- China renews record high daily Covid infections, protestors demand easing of virus-led restrictions.

- Iraq teases more output ahead of OPEC+ meeting, EU-G7 discusses oil price cap on Russian energy exports.

WTI crude oil drops to the fresh low of 2022 as bears poked $73.90 amid a broad risk-aversion wave, as well as fears of increasing supply and less demand, during early Monday. In doing so, the black gold also portrays the market’s fears of witnessing a limit on Russian oil prices.

China reports another daily all-time high of Covid cases on Monday as it marked the 40,347 numbers to spot the grim conditions in the world’s second-largest economy. “Infections rose as hundreds of demonstrators and police clashed in Shanghai on Sunday night as protests over China's stringent COVID restrictions spread to several cities,” said Reuters following that data.

Elsewhere, Iraq's state news agency quoted Saadoun Mohsen, a senior official at the country's state oil marketer (SOMO), as saying on Saturday that the nation plans to add a total of 1 million to 1.5 million barrels a day by 2025, per Bloomberg. “Export capacity from southern ports is due to increase between 150,000-250,000 barrels a day from next year,” mentioned the news.

Additionally weighing on the commodity price are the talks among the members of the Group of Seven Nations (G7) and the European Union (EU) continue to drag on the Russian oil price cap. As per the latest updates, the $65 per barrel is the sticking point as discussions are likely to resume on Monday.

Amid these plays, the US stock futures drop nearly 0.70% while the US 10-year Treasury yields fall 3.7 basis points (bps) to 3.66% by the press time.

To sum up, black gold could witness further downside as fears of demand depletion joins the hopes of higher supplies. However, talks surrounding the Russian oil price cap will be crucial for the near-term directions, in addition to the Covid-linked headlines.

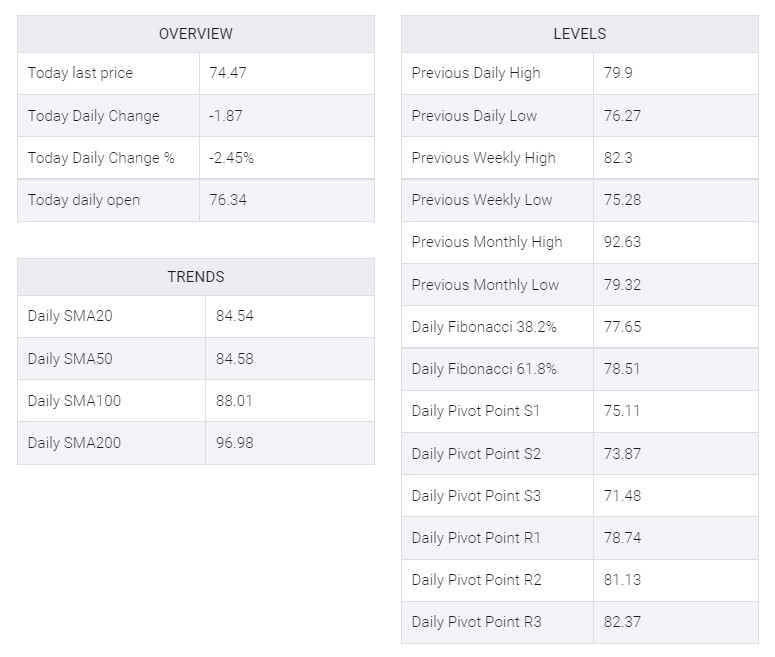

Double-top confirmation keeps WTI bears hopeful of witnessing the sub-$70.00 region on the chart.

Also read: WTI Price Analysis: Bears poke $76.00 with eyes on further downside

ADDITIONAL IMPORTANT LEVELS

No comments:

Post a Comment