- US Dollar falls while commodity currencies outperform.

- Equity prices rise in Wall Street, head for a slide in Europe.

- GBP/USD with positive momentum, tests relevant resistance.

The GBP/USD is up on Thursday for the second day in a row but the upside remains limited by the 1.2230 area. Risk appetite and a weaker dollar are supporting the pair.

In Wall Street, the Dow Jones is up by 0.72% while the Nasdaq gains by 1.10%. European indexes are in negative, with the FTSE 100 down by 0.07%. The US Dollar Index is falling by 0.25%. The best performers in FX are commodity currencies as Gold, Silver and oil rise sharply.

Economic data released on Thursday showed US Initial Jobless Claims rose as expected to 230K in the week ended December 3 while Continuing Claims increased by 62K in the week of November 26 to 1.671 million, above the 1.575 million of market consensus, hitting the highest level since early February.

On Friday, China will report the Consumer Price Index for November that is expected to show an increase of 1% (annual). The Bank of England will release the Consumer Inflation Expectations report. In the US are due the Producer Price Index and the University of Michigan Consumer Sentiment report.

GBP/USD short-term outlook

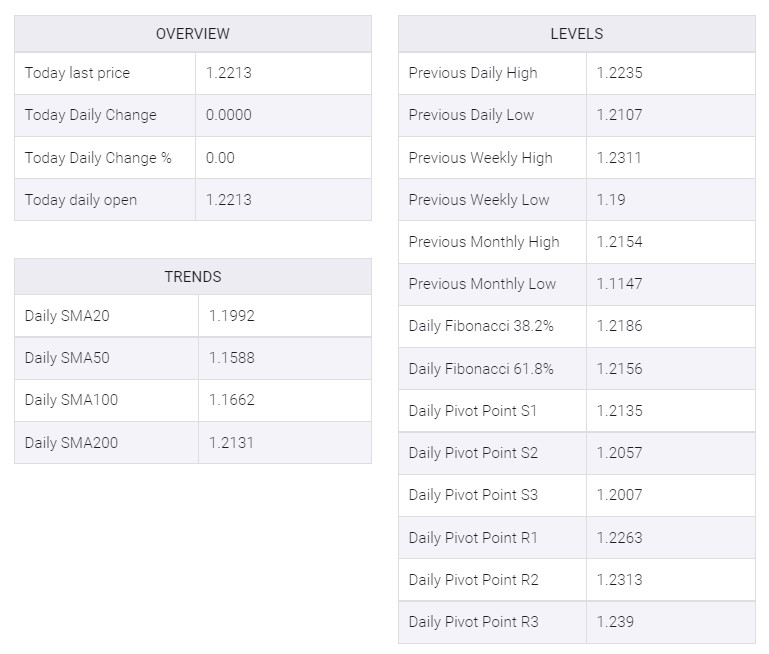

The GBP/USD pair is trading at daily highs, challenging the 1.2230 zone. If it consolidates above, the positive momentum will favor more gains, targeting 1.2260. Above, attention would turn to 1.2290/1.2300.

A failure to break 1.2230 would keep the pair sideways between that area and 1.2150. A slide below would expose the weekly low at 1.2104.

Technical levels

GBP/USD

No comments:

Post a Comment