- USD/CHF breaks consolidation range ahead of FOMC meeting.

- Investors' focus shifts to upcoming Fed meeting, 25 bps rate hike or pause?

- SNB policy decision looms next after the Fed event.

USD/CHF has broken the four-day consolidation range and remains steady just above the 0.9200 key psychological mark. The broad-based US Dollar weakness emerged after a positive risk appetite, spurred by US authorities intervening to rescue the US banking system. US Treasury Secretary Janet Yellen expressed willingness on Tuesday to provide deposit guarantees to all small banks.

Considering the ongoing liquidity crunch in the banking sector, the US Treasury Department, Federal Reserve (Fed), and US regulators have prioritized addressing the issue. Various liquidity options have already been proposed, such as the Fed opening swap lines and the discount window, as well as bank deposit guarantees for small banks despite opposition from US senators. These easing measures are likely to exert further downward pressure on the US Dollar.

Investors' focus has shifted to the upcoming Fed meeting, with markets pricing in an 85% chance of a 25-basis-point rate hike when the Fed announces its monetary policy decision on Wednesday.

Amid this banking crisis, investors are skeptical about the upcoming Fed meeting, with differing views. Following a synchronized global effort to calm the banking turmoil, the market has begun to lean toward a consensus view of a 25 basis point (bps) rate hike. Given that a summary of economic projections was conducted prior to this banking turmoil, attention will be focused on the dot plot and initial remarks from Fed Chair Powell.

Fed Chair Powell's press conference will be important to watch, as investors will try to gauge the banking and inflationary outlooks.

After the Fed, the Swiss National Bank (SNB) is next in line to deliver its policy decision.

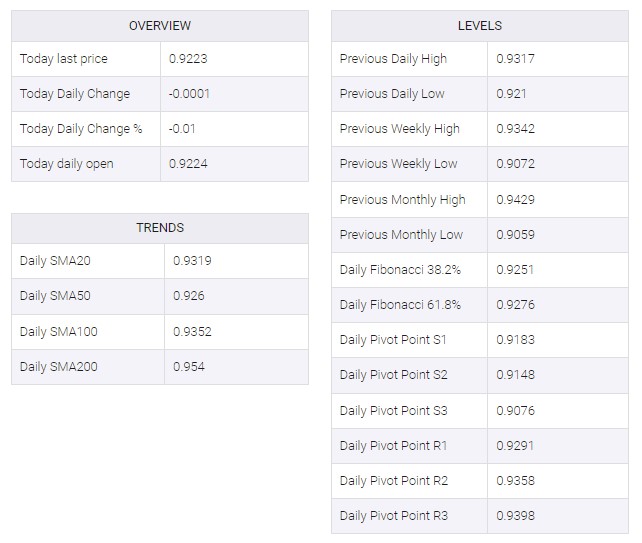

Levels to watch

USD/CHF

No comments:

Post a Comment