- EUR/USD has slipped below 1.0900 amid a risk-off market mood due to geopolitical tensions.

- Mounting expectations for a higher US core CPI are supporting the USD Index.

- Contracting Eurozone Retail Sales would be insufficient to back a neutral stance for the upcoming ECB monetary policy meeting.

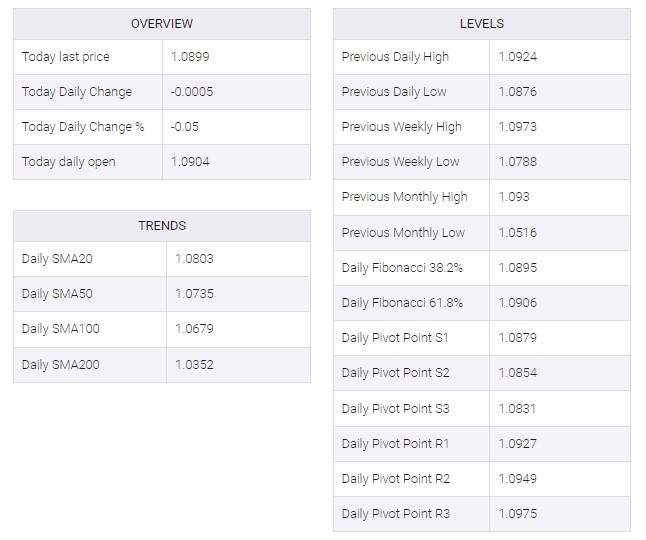

The EUR/USD pair has surrendered the round-level support of 1.0900 in the Asian session. The major currency pair has attracted significant offers as investors are getting anxious ahead of the release of the United States Inflation data. The release of the US inflation is expected to provide clear guidance about interest rates from the Federal Reserve (Fed).

S&P500 futures have shifted into a negative trajectory amid geopolitical tensions. Grudges between China and Taiwan have deepened further and the Chinese military has enforced 58 aircrafts surrounding Taiwan Island, as reported by the Taiwan ministry. A weak appetite for risk-perceived assets is indicating a risk aversion theme in the current scenario.

The US Dollar Index (DXY) has refreshed its day’s high at 102.21 as investors’ expectations are highly skewed toward hawkish Fed policy. As per the CME Fedwatch tool, 66% of bets are in favor of a 25 basis point (bp) rate hike from Fed chair Jerome Powell.

Going forward, Wednesday’s US Inflation data will be keenly watched. Headline inflation is expected to see further softening as oil prices have remained lower in March, however, the core Consumer Price Index (CPI) that strips off of oil and food prices would rebound amid higher labor cost index data. Tight labor market conditions in the US economy left no other option for firms other than offering higher payouts to retain talent. Therefore, households were handed higher funds for disposal.

On the Eurozone front, Retail Sales data will be keenly watched. Monthly Retail Sales (March) are expected to contract by 0.8% vs. an expansion of 0.3% recorded in February. And annual Retail Sales would contract further to 3.5% from a prior contraction of 2.3%.

This might delight the European Central Bank (ECB) but is not sufficient to back a neutral stance for THE upcoming monetary policy meeting.

EUR/USD

No comments:

Post a Comment